Press Release

Mogo Reports Record Revenue for Q4 2021

Record Q4 revenue of $17.0 million, up 70% year over year

Subscription and services revenue growth accelerates to 135% year over year

$193 million of cash and total investments at year end1

Company announces share repurchase program up to US$10 million

Mogo reports in Canadian dollars and in accordance with IFRS

Vancouver, British Columbia, March 23, 2022 – Mogo Inc. (NASDAQ:MOGO) (TSX:MOGO) (“Mogo” or the “Company”), one of Canada’s leading financial technology companies, today announced its financial and operational results for the fourth quarter and fiscal year ended December 31, 2021.

“It was an outstanding year for Mogo, capped off by record Q4 revenue that showcases the strength and diversification of our business today,” said David Feller, Mogo’s Founder and CEO. “Building on this strong core, we continue to invest in building the leading next gen digital wealth platform in Canada. During Q4, we launched our first version of MogoTrade – the centerpiece of our digital wealth strategy. We expect this will be an important driver of member growth and engagement as we move towards a full launch of this product in Q2 2022 and advance our mission to give members the best digital tools to help them achieve financial freedom while also making a positive social impact.”

Key Financial Highlights for Q4 & Full-Year 2021

- Total revenue for Q4 2021 increased 70% over the comparable quarter in 2020 to a record $17.0 million, the third sequential quarter of accelerating growth. Total revenue for 2021 increased 30% to $57.5 million.

- Q4 subscription and services revenue increased 135% over the comparable quarter in 2020 to $10.7 million, the fourth sequential quarter of accelerating growth. Subscription and services revenue for 2021 increased 80% to $34.4 million.

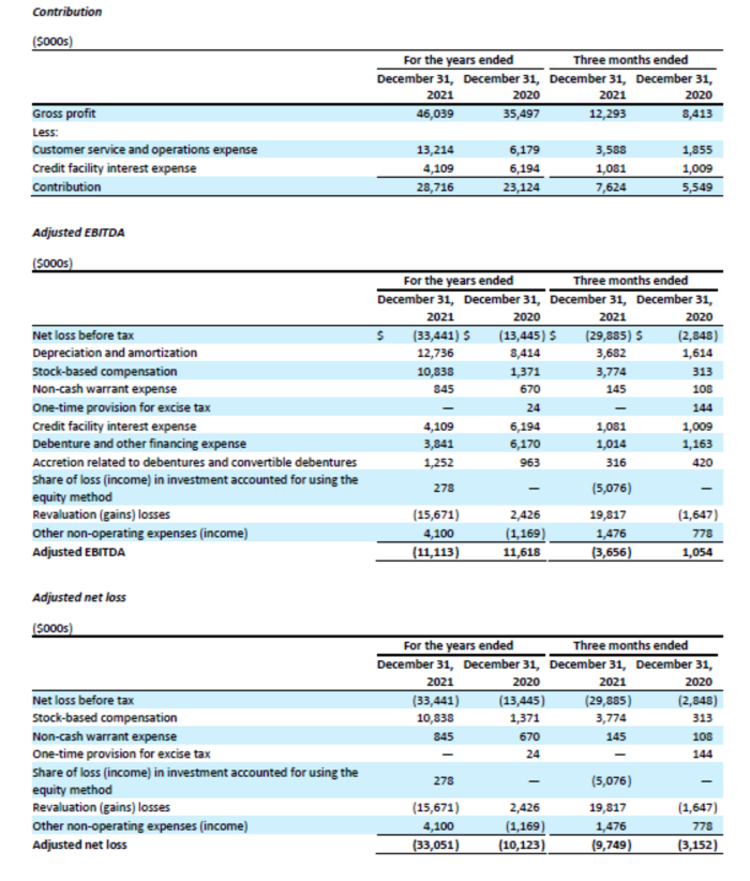

- Contribution2 increased 37% to $7.6 million in Q4 2021, compared to $5.4 million in the comparable quarter in 2020. Contribution for 2021 increased 24% to $28.7 million.

- Adjusted EBITDA2 loss of $3.7 million in Q4 2021, compared with positive Adjusted EBITDA of $1.1 million in Q4 2020, reflecting increased growth investments in the Company’s platform and products. Adjusted EBITDA loss of $11.1 million for 2021, compared to a gain of $11.6 million in 2020.

- Adjusted net loss1 of $9.7 million in Q4 2021, compared with $3.2 million in Q4 2020, and Adjusted net loss of $33.1 million for 2021 compared to $10.1 million for 2020.

- Net loss increased to $29.6 million in Q4 2021, compared with net loss of $2.8 million in Q4 2020, primarily attributable to a $22.0 million non-cash loss on revaluation of our derivative purchase warrants in Coinsquare, driven by recent broader market declines in crypto valuations. Net loss for 2021 was $33.2 million compared to $13.4 million in 2020.

- Ended the quarter with combined cash, digital assets and investments of $193 million1, including Mogo’s book value of its investments in cryptocurrency platform Coinsquare, compared to $30.6 million for the year ended 2020.

“Our Q4 subscription and services revenue exceeded our guidance range and showed accelerating growth for the fourth quarter in a row, driven by our strategic acquisitions and an increasingly diversified set of products and revenue streams,” said Greg Feller, President and CFO of Mogo. “We’ve entered 2022 with a strong balance sheet and a diverse, high-margin recurring revenue product portfolio. This base, along with the roll-out of MogoTrade and continued investments we’re making in our platform, position the company well for long-term growth. With cash, digital assets and investments of $193 million at year end, we also have deep financial resources to execute our vision.”

Business & Operations Highlights

- Launched and commenced phased rollout of MogoTrade commission-free stock trading solution following receipt of final regulatory approval from the Investment Industry Regulatory Organization of Canada (“IIROC”). The Company expects the full rollout of the product to occur in Q2 2022.

- • Mogo’s total member base increased by approximately 64%, from 1,126,000 members as at December 31, 2020 to 1,852,000 members as at December 31, 2021. Member growth in the year was a combination of organic growth as well as growth driven by our acquisition of saving and investing app, Moka.

- Mogo’s digital payments subsidiary, Carta, increased payment processing volume 58% year over year to $8.6B.

- MogoWealth ended the year with assets under management of approximately $320 million3.

- Mogo acquired 39% of Coinsquare, one of Canada’s leading crypto platforms. Coinsquare increased assets under custody to approximately $688 million at year end 2021.

- Announced the launch of ‘green’ bitcoin, an initiative which makes all bitcoin purchased on the Mogo platform climate positive. For every bitcoin purchased through its platform, Mogo will plant enough trees to more than completely absorb the CO2 emissions produced by mining that bitcoin.

- Entered a new partnership with CI Investments Services Inc., a leading Canadian broker-dealer, to provide a range of back-office services to support MogoTrade.

- In January 2022, Mogo announced a new strategic investment in NFT Trader, a Canadian company that operates a secure peer-to-peer OTC trading protocol for non-fungible tokens or NFTs.

- In March 2022, Allan Smith was appointed Head of Carta Worldwide, bringing 15 years of global leadership experience in progressively demanding roles in Fortune 50 as well as hyper-growth SaaS and fintech companies, including SoFi / Galileo (NASDAQ:SOFI).

- In March 2022, formed Mogo Ventures to manage its investment portfolio of approximately $124 million which includes strategic investments in emerging and leading ompanies in the crypto and Web3 sector, gaming, climate tech as well as investments in Bitcoin and Ether.

Financial Outlook

Based upon our ongoing investments as well as the growth opportunities we see across our business, in fiscal year 2022, Mogo is expecting:

- Total revenues of $75 million to $80 million.

- Improving adjusted EBITDA as a percentage of revenue in the second half of the year.

Share Repurchase Program

Mogo also announced today that its Board of Directors has approved a share repurchase program with authorization to purchase up to US$10 million of common shares.

“While our primary focus is to invest in our platform and new products, the market volatility may continue to present attractive buying conditions periodically. Our strong balance sheet puts us in a position to take advantage of those situations on behalf of our shareholders,” said Greg Feller.

Mogo may repurchase shares from time to time through open market purchases, in privately negotiated transactions or by other means, including through the use of trading plans intended to qualify under Rule 10b5-1 under the Securities Exchange Act of 1934, as amended. The actual timing and amount of future repurchases are subject to business and market conditions, corporate and regulatory requirements, stock price, acquisition opportunities and other factors. The share repurchase program does not obligate Mogo to acquire any particular amount of common stock, and the program may be suspended or terminated at any time by Mogo at any time at its discretion without prior notice.

1 Includes cash and cash equivalent of $69.2 million, investment portfolio of $18.1 million, digital assets of $1.7 million and investment in Coinsquare of $103.8 million. Portfolio excludes warrants held in Coinsquare.

2 Non-IFRS measure. For more information regarding our use of these non-IFRS measures and, where applicable, a reconciliation to the most comparable IFRS measure, see “Non-IFRS Financial Measures” in the Company’s MD&A for the period ended December 31, 2021.

3 Mogo’s total assets under management (“AUM”) is comprised of order execution only accounts, separately managed accounts for retail portfolio management clients that are managed on a discretionary basis and assets managed under investment fund or sub advisory mandates.

Conference Call & Webcast

Mogo will host a conference call to discuss its Q4 2021 financial results at 3:00 p.m. EDT on March 23, 2022. The call will be hosted by David Feller, Founder and CEO, and Greg Feller, President and CFO. To participate in the call, dial (833) 968-2206 or (778) 560-2782 (International). The webcast can be accessed at http://investors.mogo.ca. Listeners should access the webcast or call 10-15 minutes before the start time to ensure they are connected.

Non-IFRS Financial Measures

This press release makes reference to certain non IFRS financial measures. These measures are not recognized measures under IFRS, do not have a standardized meaning prescribed by IFRS and are therefore unlikely to be comparable to similar measures presented by other companies. These measures are provided as additional information to complement the IFRS financial measures contained herein by providing further metrics to understand the Company’s results of operations from management’s perspective. Accordingly, they should not be considered in isolation nor as a substitute for analysis of our financial information reported under IFRS. We use non IFRS financial measures, including adjusted EBITDA, adjusted net loss and contribution, to provide investors with supplemental measures of our operating performance and thus highlight trends in our core business that may not otherwise be apparent when relying solely on IFRS financial measures. Our management also uses non IFRS financial measures in order to facilitate operating performance comparisons from period to period, prepare annual operating budgets and assess our ability to meet our capital expenditure and working capital requirements. For more information, please see “Non-IFRS Financial Measures” in our Management’s Discussion and Analysis for the period ended December 31, 2021, which is available at www.sedar.com and at www.sec.gov.

The following tables present a reconciliation of each non-IFRS financial measure to the most comparable IFRS financial measure.

Forward-Looking Statements

This news release may contain "forward-looking statements" within the meaning of applicable securities legislation, including statements regarding the timing of the full launch of MogoTrade and its impact on member growth and engagement. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable by management at the time of preparation, are inherently subject to significant business, economic and competitive uncertainties and contingencies, and may prove to be incorrect. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual financial results, performance or achievements to be materially different from the estimated future results, performance or achievements expressed or implied by those forward-looking statements and the forward-looking statements are not guarantees of future performance. Mogo's growth, its ability to expand into new products and markets and its expectations for its future financial performance are subject to a number of conditions, many of which are outside of Mogo's control, including the receipt of any required regulatory approval. For a description of the risks associated with Mogo's business please refer to the “Risk Factors” section of Mogo’s current annual information form, which is available at www.sedar.com and www.sec.gov. Except as required by law, Mogo disclaims any obligation to update or revise any forward-looking statements, whether as a result of new information, events or otherwise.

About Mogo

Mogo Inc., one of Canada’s leading financial technology companies, is empowering its 1.9 million members with simple digital solutions to help them get in control of their financial health while also making a positive impact with their money. Through the free Mogo app, consumers can access a digital spending account with Mogo Visa* Platinum Prepaid Card featuring automatic carbon offsetting, easily buy and sell bitcoin, get free monthly credit score monitoring and ID fraud protection and access personal loans and mortgages. Mogo’s new MogoTrade app offers commission-free stock trading that helps users make a positive impact with every investment and together with Moka, Mogo’s wholly-owned subsidiary bringing automated, fully-managed flat-fee investing to Canadians, forms the heart of Mogo’s digital wealth platform. Mogo’s wholly-owned subsidiary, Carta Worldwide, also offers a digital payments platform that powers the next-generation card programs from innovative fintech companies in Europe, North America and APAC. To learn more, please visit mogo.ca or download the mobile app (iOS or Android).

For further information:

Craig Armitage

Investor Relations

(416) 347-8954

craiga@mogo.ca

US Investor Relations Contact

Lytham Partners, LLC

Ben Shamsian

New York | Phoenix

646-829-9701

shamsian@lythampartners.com